Jason was a careful person, so when he was planning a Caribbean vacation, he purchased

travel medical insurance just in case he became sick or injured while away. At the

resort, he saw a poster for scuba diving lessons. "I've always wanted to try that,"

he said, and signed up.

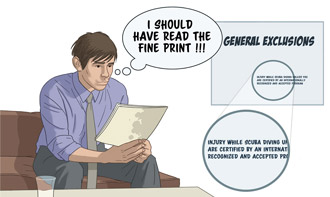

During the lesson, Jason accidentally bashed into an underwater rock and broke his

elbow. "Thank goodness I bought travel medical insurance," he thought, coming out

of the local hospital with his arm in a sling.

Would you expect to be covered if you had bought insurance like Jason's?